After a Long Delay, Asia-Pacific Is Heading for a Turnaround

After a Long Delay, Asia-Pacific Is Heading for a Turnaround

Universal Weather and Aviation is seeing an uptick in interest in long-range business jet ownership in the Asia-Pacific region.

By JENNIFER MESZAROS • Contributor - Asia

January 31, 2024

Universal Weather and Aviation is seeing an uptick in interest in long-range business jet ownership in the Asia-Pacific region.

Aligned with the heightened expectations for the 2024 Singapore Airshow, Universal Weather and Aviation’s ground-handling arm Universal Aviation is witnessing a growing interest in Asia-Pacific for long-range business jets, with operators there expressing a strong inclination to own more than one aircraft. Despite this, the economic outlook will temper the purchasing power, with many looking for a good deal, Universal regional director for Asia-Pacific Yvonne Chan told AIN.

“Owners and operators from the regions will be looking at the newer business jets with longer range that will be on display [at the airshow],” Chan said. “We should expect to see quite a number of closed deals as a result.”

The airshow comes as the region is rebounding from a prolonged pandemic-related downturn. In its most recent quarterly update on the moods and intentions of the business aviation market, Asian Sky Group (ASG) found that optimism rebounded by between 10 percent and 20 percent in various parts of Asia-Pacific in the second half of 2023.

In the Asian Sky Quarterly for the third quarter, ASG owner and director Jeffrey Lowe painted a grim picture for the first half of 2023, with 27 percent of surveyed people in the region feeling the economic situation would only get worse—a 14-point surge from 2022.

“When you don’t have a great outlook for the future, you generally don’t go out and buy a corporate jet,” he said. Further in the period, the number of operators reporting reduced flying jumped from 10 percent to 26 percent. “That big explosion in business jet flying that many other regions of the world experienced didn’t seem to be happening yet in Asia, at least through the first six months of 2023.”

But momentum in the travel and retail sectors and a 5 percent general improvement in the economic situation throughout the region contributed to the bounce in optimism. Optimism generally rose from 73 percent to 77 percent throughout the region. Southeast and Northeast Asia were the only subregions to experience an economic decline, from 83 percent to 72 percent.

© Asian Sky Group

Southeast Asia Rises

ASG noted that an increasing number of businesses relocated to Southeast Asia, making this subregion more vulnerable to soft demand for manufactured products, adverse weather, and reduced agricultural harvests. Even so, Singapore led the region in flight activity given the increased number of foreign businesses there.

“In Singapore, flight movements are not yet back to pre-Covid-19 levels. We are only at around 80 percent,” Universal’s Chan noted. “We are seeing a strong passenger load coming through Singapore. In the years preceding Covid-19, we would see many flights operating with less than four passengers. Today, we are seeing more double-digit passenger loads per flight movement.”

According to Honeywell’s latest business aviation forecast, Asia-Pacific will account for 11 percent of new global jet demand over the next five years, up one percentage point from the previous year.

According to ASG, some 37.7 percent of survey respondents across the region are interested in purchasing preowned aircraft, a number partly attributed to the lack of available new-production aircraft. Global Jet Capital’s forecast anticipates that 70 percent of business jet transactions in Asia-Pacific from 2023 to 2027 will involve preowned aircraft. Further, Global Jet Capital projects 443 such transactions over the forecast period in the region, with another 192 involving new-production aircraft.

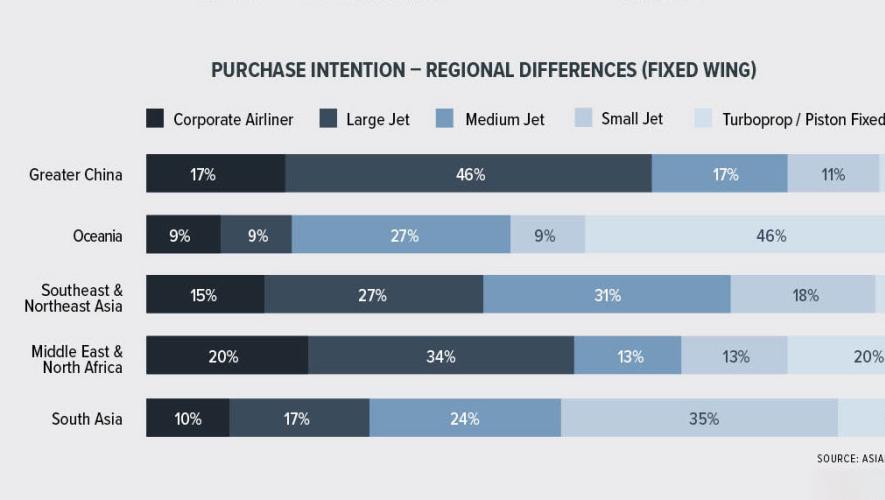

ASG further found that large-cabin jets continue to be the favored category in China, the Middle East, and North Africa. Meanwhile, nearly half of respondents to ASG’s survey anticipate chartering an aircraft over the next three years.

New operators and the establishment of joint ventures across the region are on the rise, with companies looking to create a bigger footprint, Chan further stated. Asia-Pacific charter business demand remains robust, and new trends are emerging in jet travel.

Market Hotspots

Among the markets to watch in Southeast Asia are Indonesia and Singapore, where flight traffic continues to be robust, according to Chan. Given the limitations of slots and spots at Singapore Changi Airport, Seletar remains the favored choice for business aviation on the island nation.

“Parking for [Seletar] is manageable for now,” Chan said, “and the compact parking stands here help alleviate the pressure for day-to-day operations. However, the airport’s training hours and quiet hours [are] impacting the push for Seletar to be the preferred general aviation/business aviation airport. Operators need to consider this closely when planning to operate in and out of Seletar.”

Customs, immigration, and quarantine facilities at Seletar are also limited to two counters, posing a challenge for current passenger loads. “Hopefully, with the push with automated clearance, we can see some level of improvement in the year ahead,” Chan added.

With business aviation on the upswing, the Civil Aviation Authority of Singapore (CAAS) is trying to help owners and operators. Chan noted that the issuance of an operations permit takes time due to CAAS’ foreign operators surveillance program, which follows a risk-based methodology to assess foreign carriers and business jets.

The evaluation considers factors such as the safety oversight capability of the state of operator, the state of registry, the operational capability of the carrier, and the safety records of the specific aircraft and aircraft type. “We understand and support the CAAS decision to review the safety records of operators and aircraft,” Chan said.

China Lags in Region

In the broader APAC region, Chan noted that “traffic involving China continues to remain soft, especially in and out of Singapore.” She further added that business jet traffic in China is expected to increase after this month.

ASG highlighted the contraction in China in contrast to the growth experienced in India. The business jet fleet in India grew by 0.7 percent in 2021 and 7.2 percent in 2022, while contracting by 1.7 percent and 11.2 percent, respectively, in China. In fact, ASG’s Lowe said China has lost about a quarter of its business jet fleet over the past two years, with aircraft sold elsewhere due to Covid restrictions, political sentiment, or economic slowdown.

While India moved up to the number two business jet market in the first half, “China was dead last,” he pointed out.

In the third quarter, ASG found that only 6 percent of Indian survey respondents felt conditions would worsen, the lowest mark since 2019 and better than the 23 percent of respondents across Asia-Pacific. Traffic in India particularly ticked up in August and September.

Positivity in China has not yet filtered into purchase intentions but has ticked up on the economic optimism, according to the ASG survey.

Meanwhile, demand for travel to Japan is growing at exponential rates. Chan said, “We hope to see continued support from the Japanese officials to meet this demand head-on.”

With business travel rising, Chan highlighted a trend toward cost-saving by opting for do-it-yourself (DIY) trip planning. However, she emphasized that solely taking a DIY approach “can introduce additional risks,” stressing the importance of gaining support from an experienced mission management company, especially in China.

OEM Outlook

As for the OEMs, Bombardier is among those seeing growth in the market. “The Asia-Pacific region is a very important market for Bombardier as it offers considerable growth opportunities, including aircraft sales, Bombardier Defense, certified preowned aircraft, and aftermarket potential for our immaculate medium- and long-range aircraft, including the Global 7500 and Challenger 3500 business jets,” a Bombardier spokesman told AIN.

Despite the economic slowdown in Asia, Bombardier’s Challenger and Global platforms have made notable gains in the region. In third-quarter 2023, industry flight hours for Bombardier aircraft departing APAC surged by more than 50 percent versus the same period in pre-pandemic 2019, he said. From January to November last year, flight hours increased by approximately 36 percent compared to the same period in 2022 for aircraft departing the region.

“We continue to see strong interest in our aircraft from India, Australia, and Southeast Asia and currently have Global 7500 aircraft based throughout the Asia-Pacific region in Japan, Australia, India, Greater China, Singapore, Indonesia, and Malaysia. From a sales perspective, we are well positioned in the market with our outstanding medium- and long-range family of aircraft.”

In the aftermarket sector, Bombardier remains focused on expansion, with an emphasis on growing its service center presence in Singapore, plus Tianjin, which involves a joint project with the Tianjin Airport Economic Area.

Bombardier also has high expectations for success in the region of its Global 8000. The flight-testing program is advancing steadily, with Bombardier accumulating nearly 150 test hours, including ground testing, along with approximately 1,000 hours on the ground systems. The spokesman reiterated that the aircraft remains on track to enter service in the second half of 2025.

Likewise, Dassault Aviation has considered Asia-Pacific as a key region as it begins to ramp up on its newest addition to the Falcon family, the 5,500-nm large-cabin 6X. The OEM displayed the cabin, designed for long-range missions common in the Asia-Pacific region, at the Singapore Airshow in 2020. It has since obtained certification, with the first handed over late last year.

While business aviation is still in early growth stages in certain parts of the region, Dassault’s Falcon 2000 series has been in the top 10 aircraft models in terms of hours flown in Asia-Pacific.

But arguably, support is just as important: Dassault’s ExecuJet plans to open a new purpose-built MRO facility at Subang Airport this year. The facility will measure 149,500 sq ft, providing the ability to accommodate 10 to 15 business jets of various sizes.

Gulfstream, meanwhile, has also been building up its support in the region, including additional authorized warranty centers in China. The Savannah, Georgia manufacturer likewise is seeing demand for its newest model, the G700, along with its legacy models.

“The need for business aviation has never been stronger, and customers are showing interest across our full fleet,” said Michael Swift, Gulfstream’s group v-p of sales for EMEA and APAC. “The performance capabilities Gulfstream introduced with the G650 have proven to be ideal for customers in the Southeast Asia and APAC region as interest continues to grow. We are now seeing heightened demand for our flagship G700 and the ultralong-range G800 as the high speeds and long ranges these aircraft provide are desirable for operators in the region wanting to travel nonstop to Europe and other parts of the world.”